Category: TAX

Section 80G

Section 80G – Donations Eligible Under Section 80G Table of Contents Introduction Section 80G of the Income Tax Act, 1961, provides for income tax deductions for donations made to certain eligible organizations. This section allows individuals and companies to claim a deduction of up to 100% of the donated amount, subject to certain conditions. To…

Section 80EE

Section 80EE- Income Tax Deduction for Interest on Home Loan Table of Contents Introduction Section 80EE of the Income Tax Act, 1961, is a tax deduction provision that allows first-time homebuyers to claim an additional deduction of up to Rs. 50,000 for the interest paid on a home loan taken between April 1, 2016, and…

Form 26QB

Form 26QB: TDS on Sale of Property Table of Contents Introduction Form 26QB is a challan-cum-statement form used for the payment of TDS (tax deducted at source) on the sale of immovable property in India. It is applicable when the buyer purchases any property from the seller and the consideration exceeds Rs 50 lakh. The…

Section 194J

Section 194J – TDS for Professional or Technical Services Table of Contents Introduction Section 194J of the Income Tax Act, 1961, deals with the deduction of tax at source (TDS) for professional or technical services. This section applies to payments made to professionals or technical service providers, such as architects, engineers, lawyers, and chartered accountants,…

Section 194H of Income Tax

Section 194H – TDS on Commission and Brokerage Table of Contents Introduction Section 194H of the Income Tax Act, 1961, deals with the deduction of TDS (Tax Deducted at Source) on commission or brokerage paid to a resident. This section came into effect from July 1, 2018, and applies to all payments made after this…

What is Fiscal Deficit

What is a Fiscal Deficit Table of Contents Introduction A fiscal deficit is a situation where a government spends more money than it earns in a given period, usually a year. It means that the government needs to borrow money to finance its activities and pay its bills. A fiscal deficit can have positive or…

What is Debt-to-Equity (D/E) Ratio?

What is Debt-to-Equity (D/E) Ratio? Table of Contents Introduction The Debt-to-Equity (D/E) ratio is a financial metric used to evaluate the financial leverage of a company. It is calculated by dividing the total amount of debt (borrowed money) by the total amount of equity (money invested by shareholders) in the company. A high D/E ratio…

What is Reverse Repo Rate?

What is Reverse Repo Rate? Table of Contents Introduction The reverse repo rate, also known as the repurchase rate, is an important tool used by central banks to control the money supply in an economy and maintain price stability. It is the rate at which commercial banks can park their excess funds or surplus liquidity…

What is Professional Tax?

What is Professional Tax? Table of Contents Introduction Professional tax is a direct tax that applies to individuals earning an income by way of employment, practising their profession, or trading. A practicing professional includes a lawyer, teacher, doctor, chartered accountant, etc. The tax is deducted from the individual’s monthly salary by their employer and is…

What is Capital Gain?

What are Capital Gains? Table of Contents Introduction Capital gains are the profits that are realized by selling an asset, such as stocks, bonds, or real estate. Capital gains are generally associated with investments, due to their inherent price volatility. Capital gains are taxed differently depending on how long you hold the asset before selling it. Short-term…

what is direct tax

What is Direct Tax? Table of Contents Introduction A direct tax is a tax that a person or organization pays directly to the entity that imposed it, such as the government. Examples of direct taxes in India include income tax, corporate tax, capital gains tax, and securities transaction tax. Direct taxes are essential sources of revenue for…

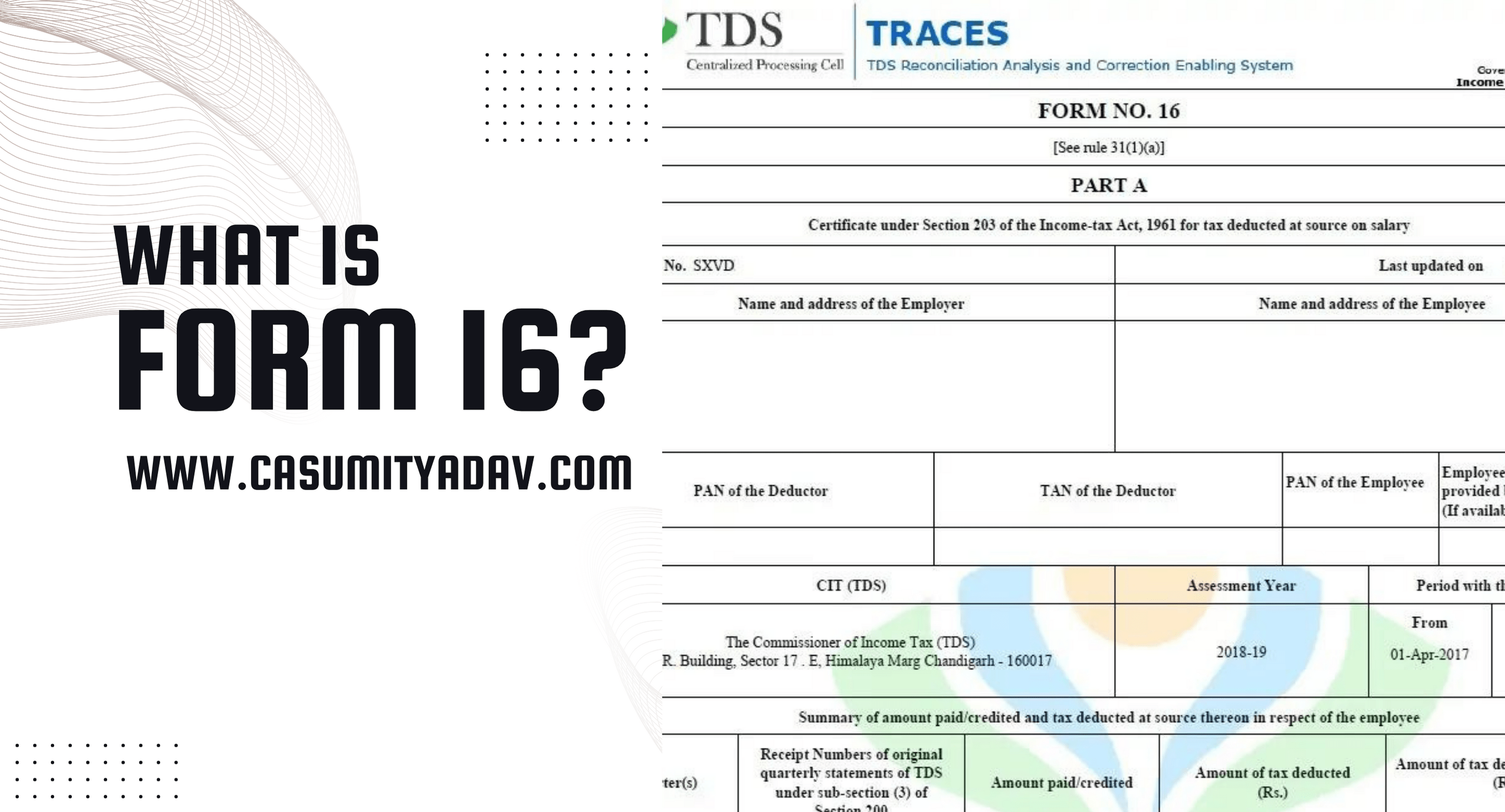

What is Form 16

What is Form 16? Table of Contents Introduction As the deadline for filing taxes approaches, the Income Tax department may send you email reminders to file your taxes on time. It is convenient to file your taxes online, and this is the current way of doing it. When filing your taxes, you will likely need…

What is Tax Deduction at Source(TDS)

Table of Contents What is Tax deduction at source (TDS) TDS stands for Tax Deducted at Source. It is a procedure implemented by the Indian government to collect taxes at the source of income. A certain percentage of tax is deducted by the payer at the time of making payments to the receiver, and this amount…

What Is Initial Public Offering (IPO)?

What Is an Initial Public Offering (IPO)? Table of Contents Introduction An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance for the first time. An IPO allows a company to raise equity capital from public investors. The transition from a private to…

AMT – What is Alternative Minimum Tax ?

What is Alternative Minimum Tax? Table of Contents AMT – What is Alternative Minimum Tax ? The Government has put in place several measures to incentivize investment in various industries, which include profit-linked deductions as well as other incentives. This measure has had the effect of reducing taxes for eligible taxpayers, which in some cases…