What is Form 16?

Table of Contents

Introduction

As the deadline for filing taxes approaches, the Income Tax department may send you email reminders to file your taxes on time. It is convenient to file your taxes online, and this is the current way of doing it. When filing your taxes, you will likely need a document called Form 16, which is a crucial financial document.

What is Form 16 in Income tax?

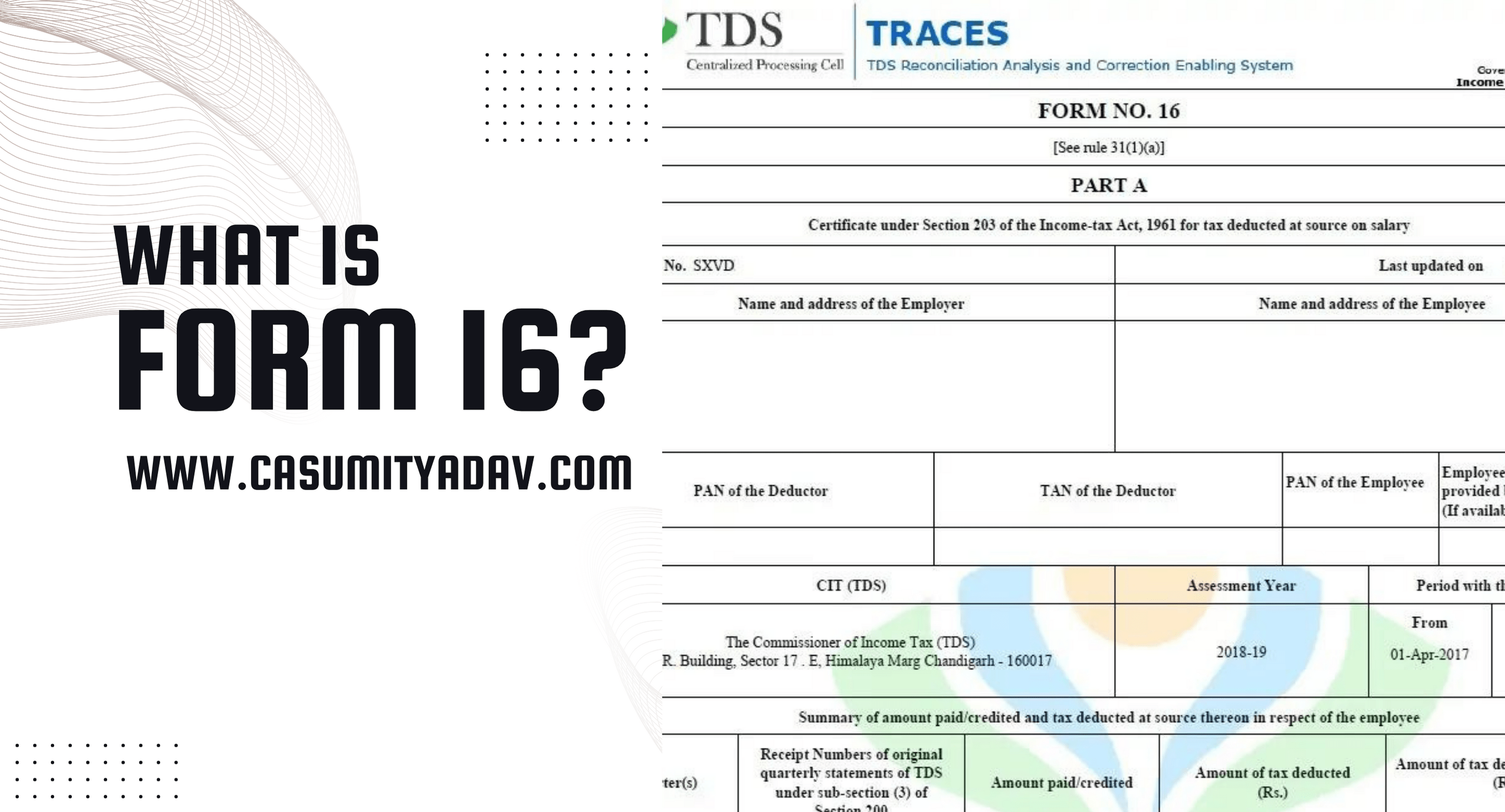

Form 16 is a certificate issued by employers to their salaried employees, which shows the details of the salary income and the tax deducted at source (TDS) on it12. It has two parts: Part A and Part B. Part A contains the information about the employer, the employee, and the quarterly TDS deposited with the government1. Part B contains the breakdown of the salary components, the exemptions under Section 10, and the deductions under Chapter VI-A2. Form 16 is an important document for filing income tax returns, as it shows the amount of tax already paid and the amount of tax liability, if any23. Form 16 is usually issued by 15th June of the year for which it is being issued2.

Some additional sentences are:

- If you have changed your job in a financial year, you should get Form 16 from both your employers2.

- You can also download Form 16 from the TRACES portal, if your employer has generated it online1.

- If you lose your Form 16, you can request a duplicate copy from your employer or use other documents such as salary slips and bank statements to file your return3.

Why is Form 16 required?

Form 16 is a certificate issued by employers to their employees that shows the salary income and the tax deducted at source (TDS) on it1. It is required for salaried individuals to file their income tax returns in India2. Form 16 contains details of income earned by an employee, the tax-saving investments and deductions that were availed as well as any tax deposited with the government by the employer1. Form 16 helps the employee to verify the accuracy of the TDS amount and claim any refund if applicable3. Form 16 also helps the employee to prepare and file their income tax return easily1.

Who is Eligible for Form 16?

According to the web search results, any salaried employee whose tax has been deducted by the employer at the source is eligible to get Form 1612. It does not matter whether their income falls under the tax exemption limit or not1. Form 16 is a certificate that contains vital information required to file income tax returns3. It is issued by the employer every year on or before 15 June of the next year3.

When is Form 16 issued?

Form 16 is a certificate issued by employers to their employees that shows the salary income and the tax deducted at source (TDS) on it1. Employers are required to issue Form 16 by 15th of June after the financial year in which the salary income was paid and tax deducted2345. For example, the Form 16 for Financial Year 2022-23 is required to be issued by June 15, 20235.

What are Form 16A & 16 B?

Form 16A and Form 16B are certificates of tax deducted at source (TDS) on income from sources other than salary1. Form 16A is issued by financial institutions, tenants, or insurance companies to individuals who receive income from fixed deposits, rent, or commission23. Form 16B is issued by property buyers to property sellers who earn income from the sale of immovable property14. Both Form 16A and Form 16B are required to file income tax returns in India2.

How can you use Form 16 to your advantage?

Form 16 is a certificate issued by employers to their employees that shows the salary income and the tax deducted at source (TDS) on it1. You can use Form 16 to your advantage in the following ways:

- You can use Form 16 to file your income tax return easily and accurately, as it contains all the details of your income and deductions under various sections of the Income Tax Act1.

- You can use Form 16 to claim a refund of excess TDS deducted by your employer, if any, by filing your income tax return online2.

- You can use Form 16 to verify the TDS deposited by your employer with the Income Tax Department, by checking the Form 26AS online3. Form 26AS is a consolidated annual tax statement that shows all the taxes paid on your behalf by various sources, such as employers, banks, etc3.

- You can use Form 16 to plan your tax-saving investments for the next financial year, by looking at the breakup of your salary and the deductions availed under Chapter VI-A of the Income Tax Act4. Chapter VI-A covers various deductions such as Section 80C, Section 80D, Section 80E, etc4.

How to Download Form 16?

Form 16 is a certificate issued by your employer that shows your salary income and the tax deducted at source (TDS) on it. You can download Form 16 online from the TRACES portal of the Income Tax Department. Here are the steps to download Form 16 online:

- Visit the TRACES portal .

- Login using your User ID, Password, PAN and TAN.

- Go to Downloads tab and select Form 16.

- Select the financial year for which you need Form 16.

- Enter your PAN and click on Go.

- Download the Form 16 PDF file and save it on your computer.

- The password to open Form 16 PDF file is your PAN followed by your date of birth in DDMMYYYY format3. For example, if your PAN is ABCDE1234F and your date of birth is 01/01/1990, then your password is ABCDE1234F01011990.

How to File ITR with Form 16?

Filing income tax return (ITR) with Form 16 is a simple and convenient process. Form 16 is a certificate issued by your employer that shows your salary income and the tax deducted at source (TDS) on it. You can use Form 16 to prepare and file your ITR online, as it contains all the details of your income and deductions. Here are the basic steps to file ITR with Form 16:

- Download Form 16 from the TRACES portal of the Income Tax Department or request it from your employer.

- Form 16 has two parts:

- Part A and Part B.

- Part A shows the quarterly details of TDS deducted and deposited by your employer.

- Part B shows the breakup of your salary and the deductions availed under various sections of the Income Tax Act.

- Visit the e-filing website of the Income Tax Department and login with your credentials. If you are a new user, you need to register first with your PAN and other details.

- Go to ‘e-File’ and click on ‘Prepare and submit ITR online’.

- Select the appropriate ITR form and assessment year. For salaried individuals, ITR-1 or ITR-2 is usually applicable, depending on the sources of income.

- Fill in the details as asked in the ITR form, using the information from Form 16. You need to enter your personal details, income details, tax details, deductions, and taxes paid.

- You can also claim a refund of excess TDS deducted by your employer, if any, by entering your bank account details.

- Verify the tax computation and the amount of tax payable or refundable. If there is any tax payable, you need to pay it online using the e-payment facility of the Income Tax Department .

- Submit your ITR online and verify it using any of the available methods, such as Aadhaar OTP, net banking, or digital signature. You will receive an acknowledgement email from the Income Tax Department once your ITR is successfully verified.

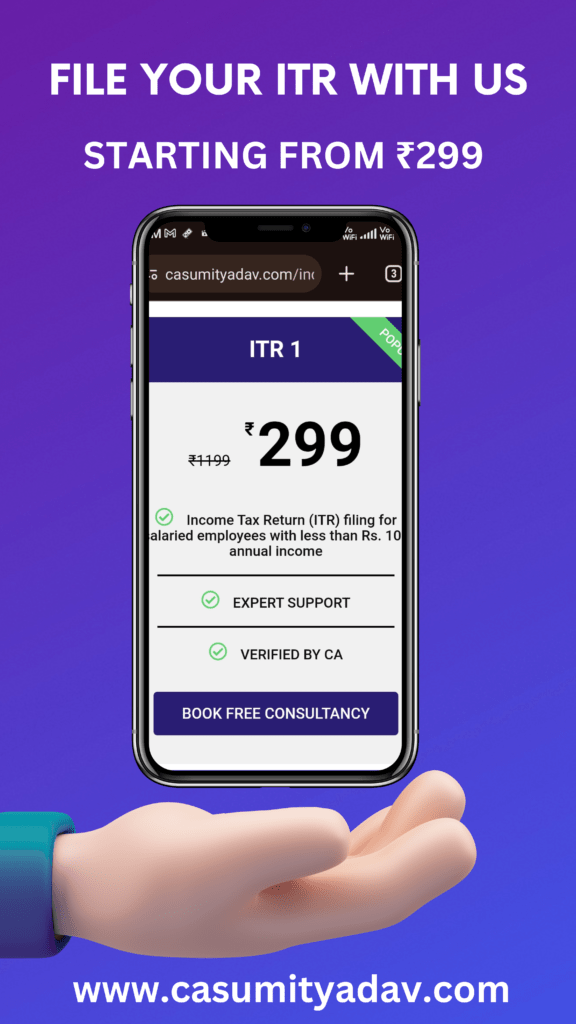

You can also use Sumit Yadav tax Consultancy, an online tax filing platform, to file your ITR with Form 16. You just need to upload your Form 16 PDF and Sumit yadav tax Consultancy will automatically fill in the details in the ITR form. You can also review and edit the information before submitting your ITR. Sumit Yadav Tax Consultancy also provides expert assistance and tax-saving suggestions to help you file your ITR easily and accurately.

Related Articles